All Categories

Featured

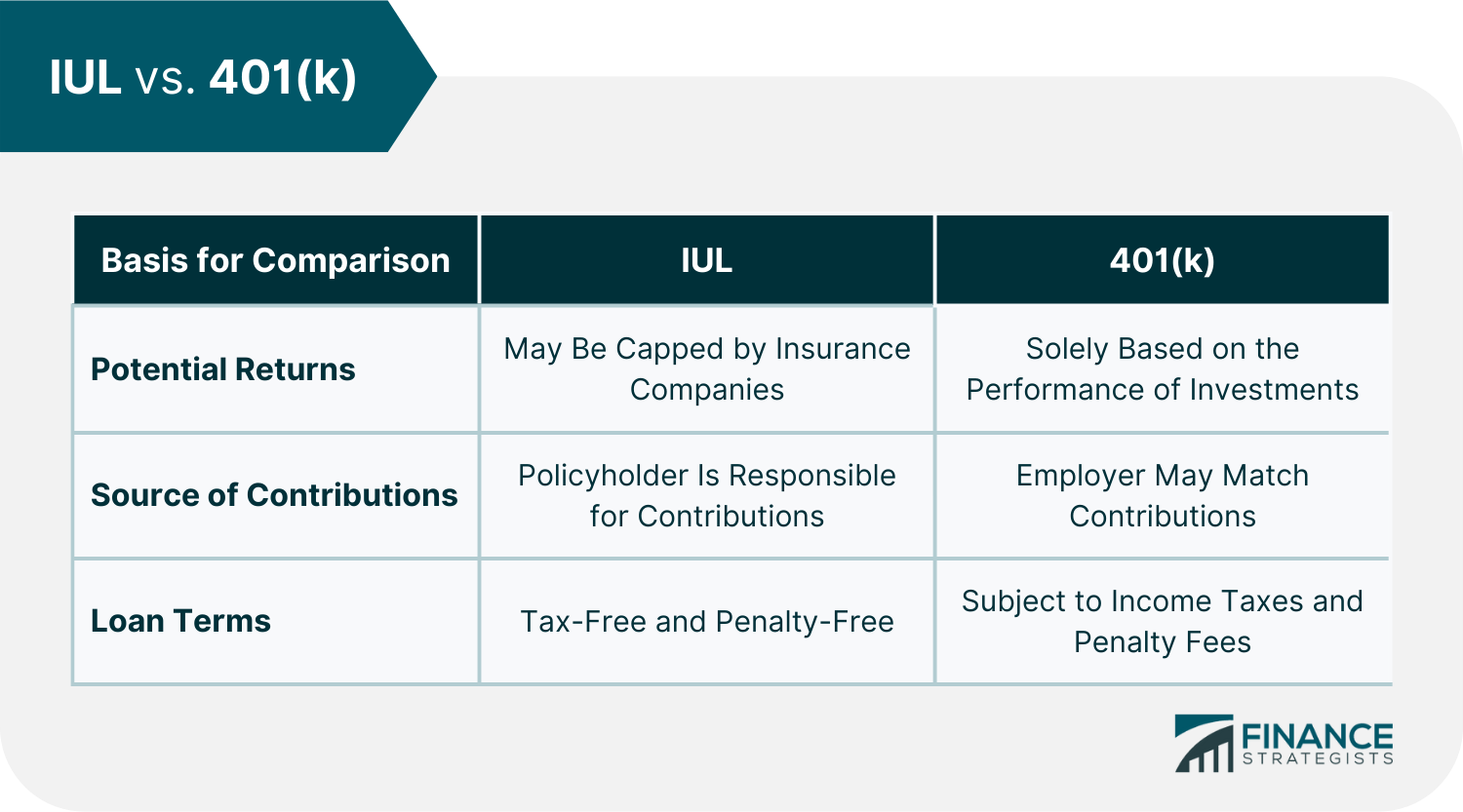

IUL contracts safeguard versus losses while supplying some equity threat costs. Individual retirement accounts and 401(k)s do not offer the same drawback defense, though there is no cap on returns. IULs have a tendency to have actually have made complex terms and higher fees. High-net-worth individuals wanting to decrease their tax burden for retired life might benefit from buying an IUL.Some investors are much better off purchasing term insurance policy while maximizing their retirement strategy payments, as opposed to acquiring IULs.

If the underlying supply market index rises in a provided year, owners will certainly see their account boost by a proportional amount. Life insurance policy firms use a formula for identifying exactly how much to attribute your money balance. While that formula is linked to the performance of an index, the amount of the debt is often mosting likely to be less.

Companies usually give coordinating payments to 401(k)s as an advantage. With an indexed global life plan, there is a cap on the quantity of gains, which can restrict your account's growth. These caps have annual ceilings on account credit scores. If an index like the S&P 500 rises 12%, your gain might be a fraction of that amount.

401k Vs Iul

Unalterable life insurance trusts have long been a popular tax sanctuary for such individuals. If you fall under this group, take into consideration chatting to a fee-only economic advisor to talk about whether acquiring permanent insurance fits your overall method. For lots of capitalists, though, it might be much better to max out on contributions to tax-advantaged retirement accounts, specifically if there are contribution suits from a company.

Some policies have an assured price of return. Among the essential features of indexed universal life (IUL) is that it provides a tax-free distributions. It can be a beneficial device for capitalists that desire choices for a tax-free retirement. Typically, financial experts would certainly recommend contribu6ting to a 401(k) prior to an IRA particularly if your employer is offering matching payments.

Property and tax obligation diversification within a portfolio is increased. Pick from these items:: Offers long-term development and revenue. Suitable for ages 35-55.: Deals flexible insurance coverage with modest money worth in years 15-30. Perfect for ages 35-65. Some points clients ought to consider: For the survivor benefit, life insurance coverage products bill costs such as death and expenditure threat fees and surrender costs.

Retirement planning is crucial to preserving economic security and retaining a details criterion of living. of all Americans are stressed regarding "keeping a comfy standard of life in retired life," according to a 2012 survey by Americans for Secure Retirement. Based on current stats, this majority of Americans are justified in their problem.

Department of Labor approximates that an individual will certainly require to preserve their present requirement of living when they start retirement. In addition, one-third of united state homeowners, between the ages of 30 and 59, will not have the ability to maintain their standard of living after retired life, even if they postpone their retirement up until age 70, according to a 2012 research study by the Worker Advantage Research Institute.

Iul Vs Ira

In the same year those aged 75 and older held a typical debt of $27,409. Alarmingly, that number had more than doubled considering that 2007 when the ordinary debt was $13,665, according to the Employee Benefit Research Study Institute (EBRI).

Demographics Bureau. 56 percent of American senior citizens still had outstanding financial debts when they retired in 2012, according to a survey by CESI Debt Solutions. What's even worse is that previous study has revealed debt amongst retirees has been on the rise throughout the past few decades. According to Boston University's Facility for Retirement Research, "In between 1991 and 2007 the number of Americans in between the ages of 65 and 74 that applied for personal bankruptcy raised an astonishing 178 percent." The Roth IRA and Policy are both devices that can be utilized to construct considerable retired life financial savings.

These monetary devices are similar in that they profit policyholders who wish to generate savings at a lower tax rate than they might come across in the future. However, make each more appealing for people with differing requirements. Determining which is better for you relies on your individual scenario. The policy expands based on the interest, or dividends, credited to the account.

That makes Roth IRAs optimal cost savings lorries for young, lower-income employees who live in a lower tax obligation bracket and that will gain from decades of tax-free, compounded development. Since there are no minimum called for payments, a Roth individual retirement account gives investors manage over their individual objectives and run the risk of tolerance. Additionally, there are no minimum called for circulations at any kind of age throughout the life of the plan.

To compare ULI and 401K strategies, take a minute to recognize the basics of both items: A 401(k) lets staff members make tax-deductible payments and take pleasure in tax-deferred growth. When workers retire, they usually pay tax obligations on withdrawals as regular income.

Ira Vs Iul: Which Investment Vehicle Works Best For Retirement?

Like various other irreversible life plans, a ULI plan additionally allots component of the costs to a cash money account. Given that these are fixed-index plans, unlike variable life, the policy will certainly likewise have an ensured minimum, so the money in the cash account will certainly not lower if the index declines.

Policy proprietors will additionally tax-deferred gains within their cash account. They may likewise enjoy such other economic and tax advantages as the capability to obtain versus their tax obligation account as opposed to taking out funds. Because way, global life insurance coverage can function as both life insurance policy and a growing asset. Explore some highlights of the advantages that universal life insurance policy can provide: Universal life insurance coverage plans do not impose restrictions on the size of plans, so they may supply a way for employees to save even more if they have currently maxed out the internal revenue service limits for other tax-advantaged monetary products.

The IUL is better than a 401(k) or an IRA when it involves saving for retirement. With his almost 50 years of experience as an economic strategist and retired life preparation professional, Doug Andrew can reveal you exactly why this is the instance. Not just will Doug describes why an Indexed Universal Life insurance policy contract is the much better lorry, however also you can also discover just how to optimize assets, lessen tax obligations and to empower your genuine riches on Doug's 3 Dimensional Wide range YouTube channel. Why is tax-deferred accumulation much less desirable than tax-free build-up? Learn how postponing those tax obligations to a future time is taking an awful risk with your cost savings.

Latest Posts

Iul Vs Term Life

Indexed Whole Life

Columbia Universal Life