All Categories

Featured

There is no one-size-fits-all when it comes to life insurance./ wp-end-tag > In your active life, monetary self-reliance can appear like an impossible objective.

Pension, social protection, and whatever they would certainly taken care of to conserve. It's not that simple today. Fewer employers are providing conventional pension and lots of companies have decreased or terminated their retired life plans and your capability to rely entirely on social safety and security is in concern. Even if benefits have not been decreased by the time you retire, social safety and security alone was never ever intended to be sufficient to pay for the way of life you want and deserve.

/ wp-end-tag > As part of an audio monetary approach, an indexed universal life insurance coverage policy can aid

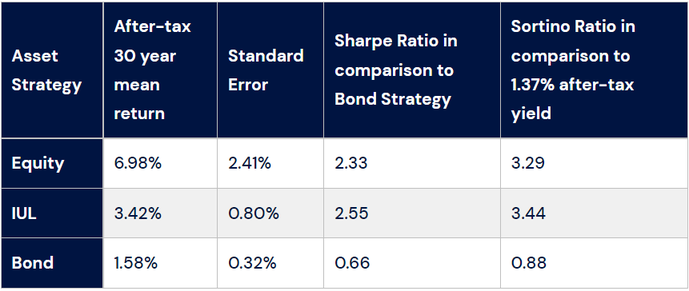

you take on whatever the future brings. Before devoting to indexed global life insurance, below are some pros and cons to take into consideration. If you pick a good indexed global life insurance coverage plan, you might see your money value expand in value.

Universal Life Insurance For Retirement Income

If you can access it at an early stage, it might be helpful to factor it right into your. Since indexed universal life insurance calls for a certain level of threat, insurance provider tend to maintain 6. This kind of plan additionally supplies (fixed indexed universal life insurance reviews). It is still guaranteed, and you can readjust the face amount and bikers over time7.

Commonly, the insurance coverage firm has a vested interest in performing much better than the index11. These are all elements to be thought about when picking the best type of life insurance for you.

Indexed Universal Life Leads

Given that this type of policy is more complicated and has a financial investment element, it can often come with greater costs than various other policies like whole life or term life insurance coverage. If you don't believe indexed universal life insurance policy is right for you, here are some options to take into consideration: Term life insurance policy is a short-term plan that normally provides coverage for 10 to 30 years.

Indexed universal life insurance policy is a sort of plan that offers a lot more control and versatility, in addition to higher cash worth development possibility. While we do not use indexed universal life insurance policy, we can provide you with even more information regarding whole and term life insurance policy plans. We advise exploring all your choices and chatting with an Aflac representative to discover the very best fit for you and your family members.

The rest is added to the cash worth of the plan after costs are deducted. The cash money worth is credited on a month-to-month or annual basis with rate of interest based on rises in an equity index. While IUL insurance might prove valuable to some, it is necessary to understand just how it works prior to purchasing a policy.

Latest Posts

Iul Vs Term Life

Indexed Whole Life

Columbia Universal Life